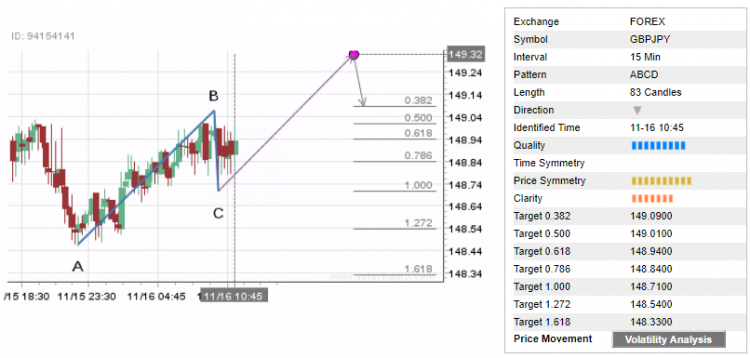

Autochartist identifies four different Fibonacci Patterns: ABCD, 3 Drive, 3 Point Retracement and the 3 Point Extension.

One major benefit is having a program identify and calculate the patterns. Hours can be spent trying to determine whether a pattern taking place is adhering to the generally accepted Fibonacci patterns. Even after this work is completed, the analyst will still have to determine whether a trading opportunity is taking place.

Autochartist takes care of both of these possibilities. On one hand it attempts to identify emerging patterns so that the trader can prepare for potential trading opportunities. On the other hand, the completed patterns show the trader an active pattern or one that can be acted upon should the trader decide to do so.

Fibonacci pattern analysis can require a great deal of patience and mathematics. Autochartist has built into the program the ability to analyze hundreds of patterns and apply the mathematics necessary to identify trading alerts. This gives the trader time to analyze the trading opportunity presented to him which means more time to fine tune the entry, trailing stop and exit strategies. Eliminating the need for patience also helps to reduce the emotional strain that market and trading can have on a trader.

Another benefit of using Fibonacci patterns as an analysis is that they give the trader an objective view of the market. They are created simply by reading the pattern. This eliminates bias such as news events or economic reports. Simply stated, Fibonacci patterns look at the market and say “this is what it has done” and “this is what it can do based on its past history”. It is pretty straightforward mathematical analysis of the market without outside influences.

Fibonacci patterns also help identify for a trader whether the market is going to pull back into a particular price area or whether it is likely to extend. This helps the trader decide whether he should wait for a better entry price than currently offered or whether he will have to pay up for the opportunity to capture higher prices.

Another key benefit of using Fibonacci patterns to trade is that the creation of price level targets can help the trader determine reasonable price targets. This helps when determining to execute a trade because the risk/reward of the trade can be easily calculated.

Like any trading tool, it is highly suggested that the trader study and experiment with these Fibonacci patterns before actually putting money on the line. This will help the trader determine some of the quirks of this type of analysis. It is very important that the trader confirm that this type of analysis suits his trading style. Often traders are convinced because of a few early successes that a particular trading discipline is suited for him. He gets blinded by the profits and fails to realize that there are risks involved.

In order to benefit the most from using Fibonacci patterns, it is very important to try to identify which patterns work best under which conditions. It is in understanding this portion of the analysis tool that a trader can get a real grasp of how to use Fibonacci patterns successfully.